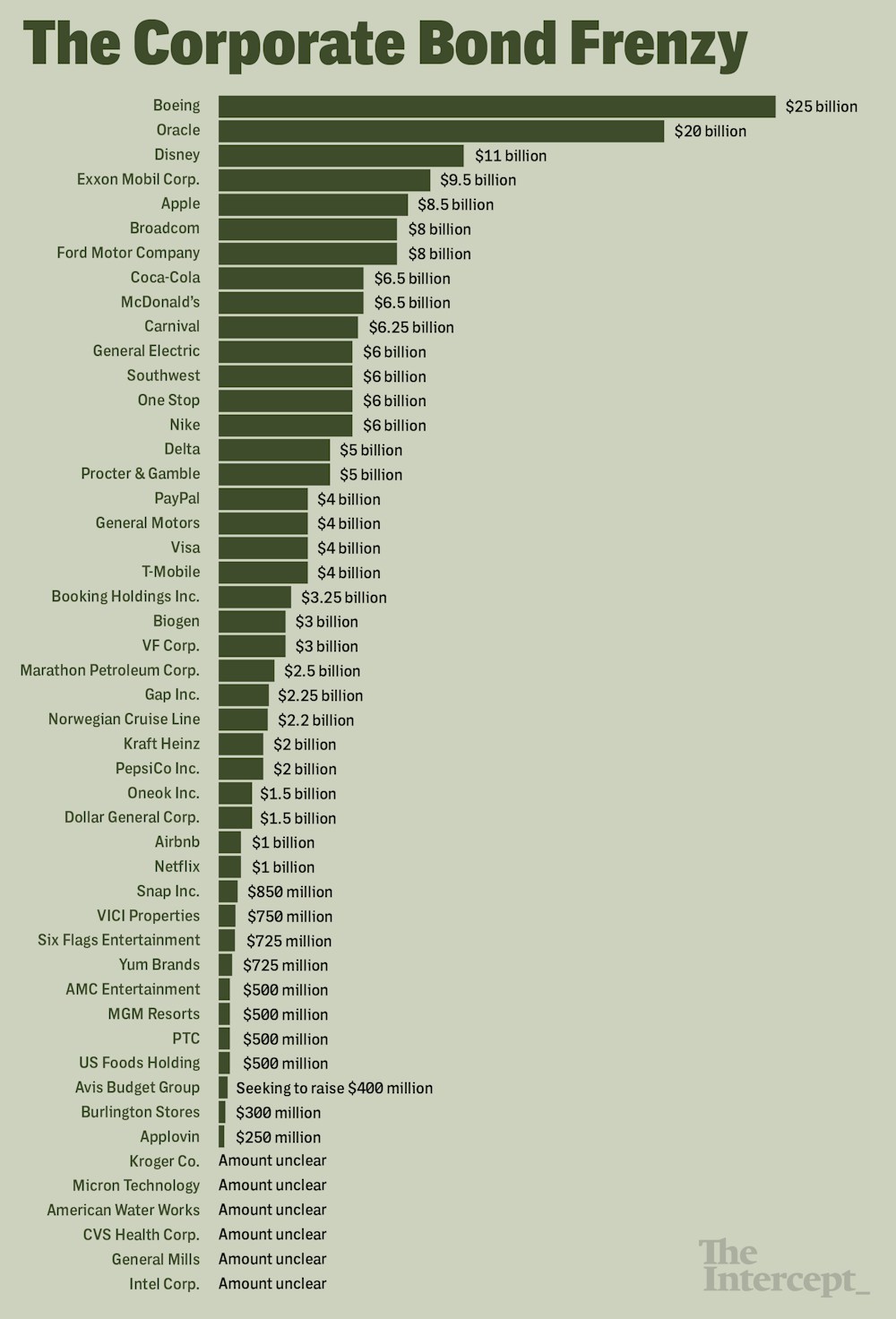

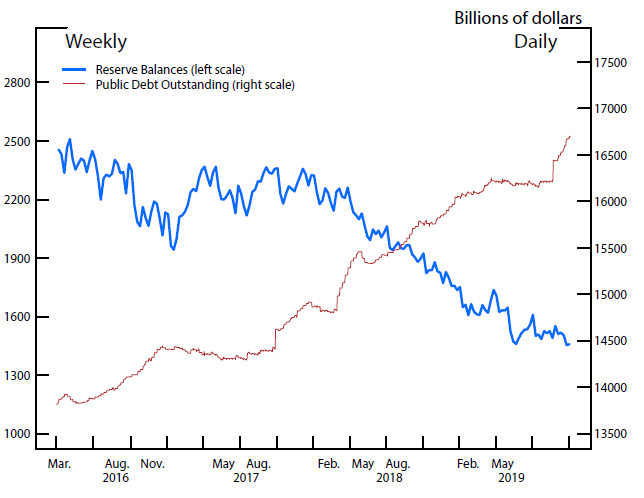

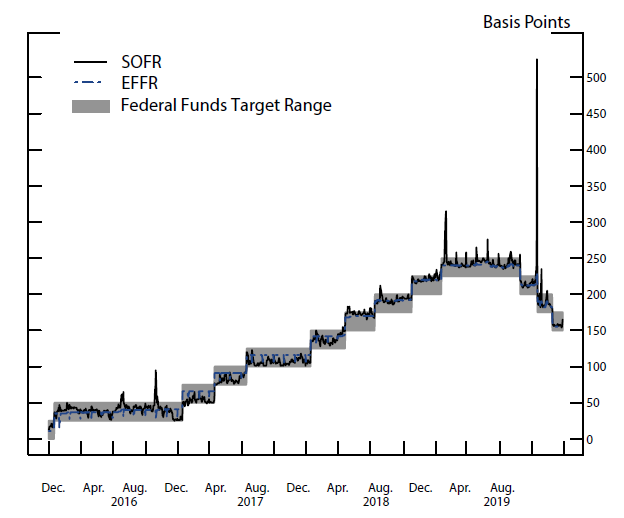

The reason there is a news blackout of the Fed's secret bailouts of 2019 is that the Fed would be forced to admit that it had to secretly bail out the affiliates

An overview of the Fed's new credit policy tools and their cushioning effect on the COVID-19 recession - ScienceDirect

Full article: Too-Big-To-Fail: Why Megabanks Have Not Become Smaller Since the Global Financial Crisis?

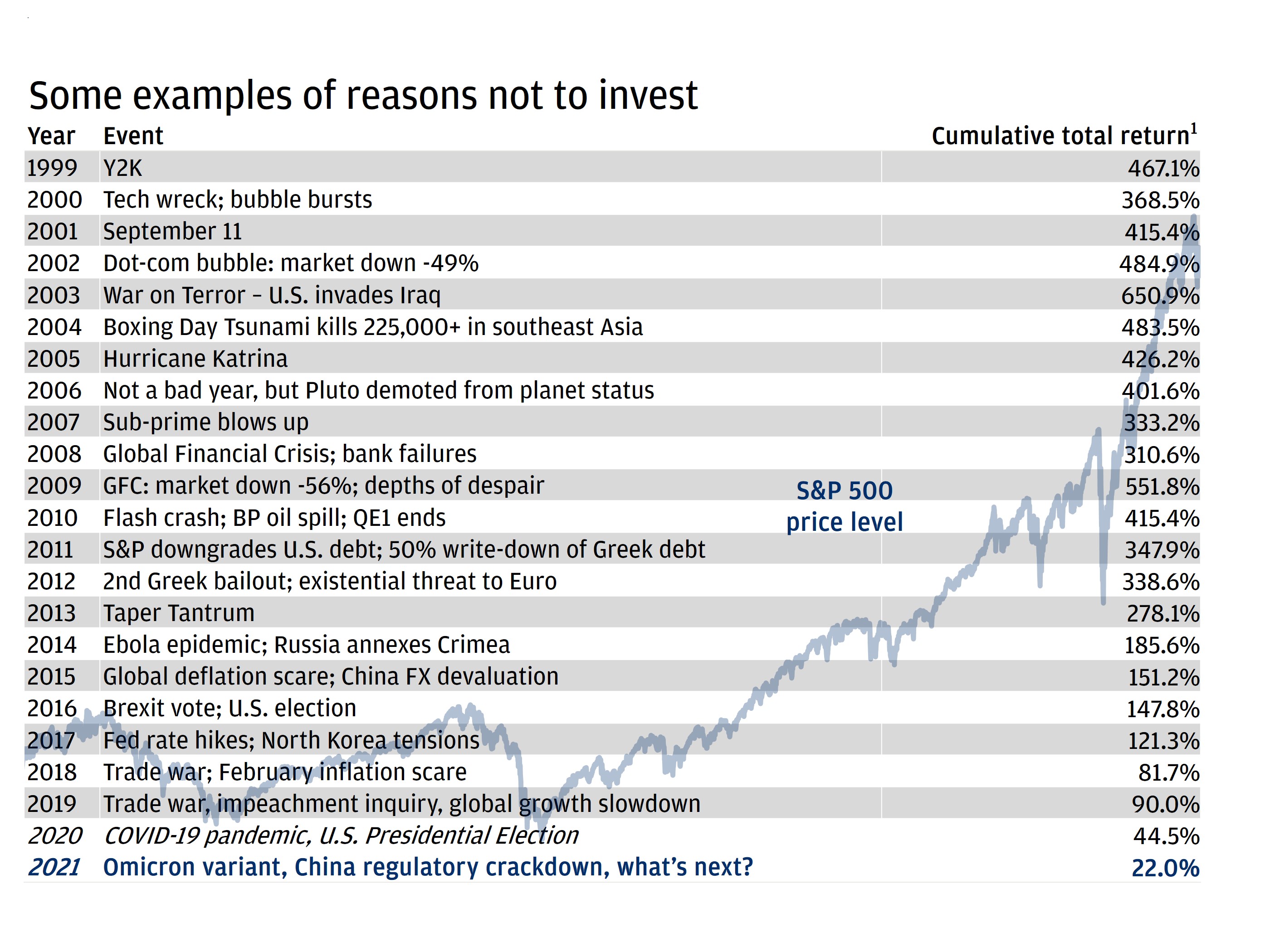

Bailouts And The Demise Of Capitalism And Free Markets - Real Investment Advice - Commentaries - Advisor Perspectives